What is Documentary Collection

Documentary collection is a trade financing method that allows an exporter to receive payment for their goods from an importer through the exchange of relevant documentation between the parties’ financial institutions. The exporter’s institution collects payment from the importer’s institution for the release of the title to the transported goods.

A bill of exchange or draft, which is a legal demand for payment, is a key document in a documentary collection. There are two types of documentary collection: documents against payment and documents against acceptance.

In documents against payment, the importer must pay the face amount mentioned in the shipping documents upon receipt. This is the most typical method of documentary collection because it carries a lower risk to the vendor.

In documents against acceptance, a payment deadline is imposed on the importer. The bank releases the documents to the buyer once the draft is accepted.

A documentary collection may be a suitable option in the following situations:

- There is a strong and established relationship between the exporter and the importer.

- The exporter has confidence in the political and economic stability of the country where the goods will be imported.

- An open account sale is considered too risky, and the importer refuses to use a letter of credit.

- The importer’s ability or willingness to pay is certain.

- There are no foreign exchange controls that would restrict the payment process in the importer’s country.

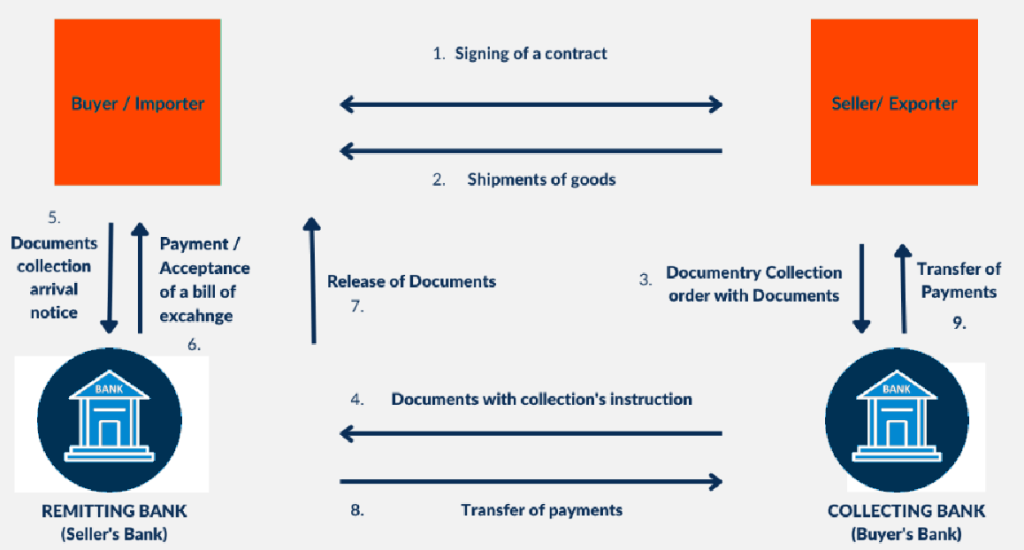

Here is a summary of the steps involved in the documentary collection process:

- The exporter and importer agree to the terms of the trade and the payment method, which is a documentary collection.

- The exporter prepares and sends the required documents, including the bill of exchange or draft, to their financial institution.

- The exporter’s financial institution forwards the documents to the importer’s financial institution, along with a request for payment.

- The importer’s financial institution releases the payment to the exporter’s financial institution upon receipt of the documents and request for payment.

- The exporter’s financial institution releases the documents to the importer upon receipt of payment.

- The importer receives the goods and pays the importer’s financial institution the agreed-upon amount.

- The importer’s financial institution releases the payment to the exporter.

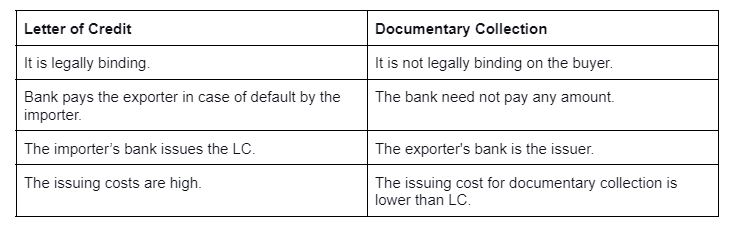

There are several differences between a letter of credit and a documentary collection:

- A letter of credit is a legally binding document that guarantees payment to the seller, while a documentary collection allows the buyer to refuse a shipment if it does not meet certain standards.

- The importer’s bank issues a letter of credit, while the exporter’s bank issues a documentary collection.

- In a letter of credit, the bank pays the exporter if the importer is unable to do so. In a documentary collection, the bank does not have this liability.

- A letter of credit is generally more expensive to issue than a documentary collection.

- A letter of credit may be preferred in situations where trade is risky due to location or other factors, while a documentary collection may be more suitable for parties with established and trustworthy relationships.

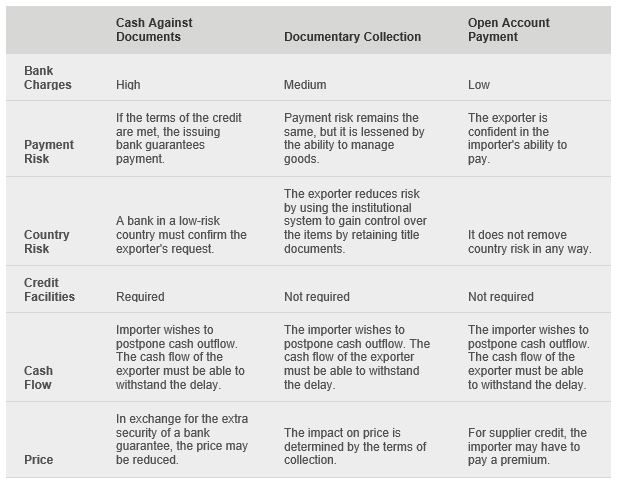

In a cash against documents transaction, the exporter (also known as the drawer) sends a bill and transit documents to their bank (the remitting bank) for delivery to the importer’s bank (the collecting bank). The documents are only released to the importer after the collecting bank has received payment from the remitting bank.

In an open account sale, the goods are shipped and delivered to the importer before payment is due. The importer receives the goods and pays the exporter’s bill on a specified date.

In contrast, a documentary collection involves the exchange of documentation and payment between the parties’ financial institutions, as previously described.

Advantages of Documentary Collection:

- The exporter receives reliable and secure support from the bank in collecting payment for the export.

- The process is simple, quick, and inexpensive compared to a letter of credit.

- Document management is streamlined.

- Payments are received more quickly.

- The seller retains ownership of the goods until payment is received.

- The exporter is covered by a payment guarantee.

- The seller can expand their business globally.

- It is possible to keep a record of overdue collections.

- It is less expensive than a letter of credit.

- The seller can conduct monetary transactions.

Disadvantages of Documentary Collection:

- The risk of non-payment may be higher. If the bill of exchange stipulates payment after delivery, the exporter loses control of the goods but risks non-payment on the due date.

- The bank’s role is limited, and payment is not guaranteed. The bank does not verify the shipping documents or guarantee payment from the buyer.

- The exporter’s cash flow may be strained, especially if the bill of exchange allows for longer credit terms. The exporter is exposed to foreign exchange risk from the sale contract until the moment of payment.

Frequently Asked Questions:

Who is the drawer in a documentary collection?

The seller (drawer) ships the goods and prepares the buyer’s documents by issuing an order for collection. The seller sends the required documents and the collection order to their bank (the remitting bank).

Who is the drawee in a documentary collection?

The person or business on whom a draft is based. The drawer directs the drawee to pay a fixed sum to the payee, the payee’s order, or the bearer. The buyer is usually the drawee in a documentary collection.

How does a documentary collection work as a payment method?

Both the importer and the exporter agree to do business together. Once the goods are shipped, they send the documents to the exporter’s bank. The importer’s bank forwards and presents the documentation. The exporter is then paid.

What is the difference between a documentary collection and a documentary credit?

A letter of credit is a contract in which the issuing bank (usually the buyer’s or importer’s bank) commits to pay the seller’s bank when the goods are delivered with specific documentation, including very precise details. In a documentary collection, if the buyer decides not to purchase the goods, the bank is not obligated to pay the seller or exporter.

What are the types of documentary collections?

There are two types of documentary collections: Documents against Payment Collection (D/P) and Collection of Documents Against Acceptance (D/A). In a D/P collection, the delivery documents are only given to the importer when payment is made. In a D/A collection, acceptance of a Bill of Exchange or a guarantee of payment is required before delivery documents are handed over.

What is the downside of a documentary collection?

Payment is not guaranteed, limiting the bank’s role. The seller cannot verify the documents.